Reader Question: We want to make our first real estate investment purchase. We have decided on investing in older 2-4 family apartments. It appears there are different ways to decide what a property is worth. How do you evaluate an old three family? Julie and Rob P.

Reader Question: We want to make our first real estate investment purchase. We have decided on investing in older 2-4 family apartments. It appears there are different ways to decide what a property is worth. How do you evaluate an old three family? Julie and Rob P.

Monty’s Answer: There are many theories regarding the best way to evaluate an investment property. These theories are partly a myth, part huckster, part ignorance and part truth. In fact, there is only one universally accepted method to evaluate real property. The method used by real estate appraisers is the time tested and logical process in determining property values.

Begin by gathering all the information about the property that impacts value. There are many items to evaluate such as real estate taxes, lot size, building dimensions, the style of building and more. Once compiled, this information is analyzed utilizing three different methods:

- cost new, less depreciation – cost to reproduce?

- market approach – sale price of similar properties?

- income approach – what is the income history?

The necessary information gathered for each of the approaches is different, and judgment based on experience will often give more weight to one approach over the others. Here is a simple review of each method:

Cost new less depreciation

The cost to replicate the subject property, minus annual depreciation equals value. To look at a property in this light, one must have the information about the costs of each component part and the labor and soft costs to assemble it. Why is this important? In most instances, cost sets the upper limit of value. Why would someone buy a used home if they could buy a brand new one for the same price? One of the challenges with this approach is the quality of workmanship and materials. Identical floor plans can cost $125.00 per square foot, or $300.00 per square foot based on the labor cost of the contractor and the selected materials.

The market approach

What is the supply and demand dynamics for properties similar to the property being scrutinized? The basic test is to locate at least three properties the most similar to the subject property and make an adjustment to the comparable property to compensate for the differences. The adjustment can add value or subtract from the value of the comparables. The “subject property” is never adjusted, only the comparables adjust. The priority of comparable choices is elapsed time from the date of the analysis, as fresh data most accurately reflects trending value.

The income approach

Income is weighted more heavily as the value and type of property transforms from a personal residence to strictly investment property. A hotel or shopping center is valued almost entirely on the net income the property generates historically. The cost approach and the market approach remain a factor with residential rental properties until the size of a building diminishes the usefulness for those calculations. As the buildings become more rare the information utilized for the cost, and market approaches become less relevant.

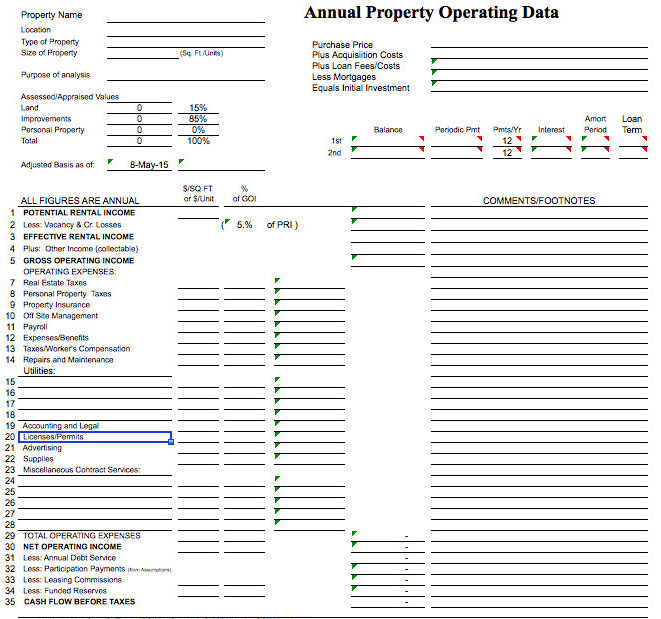

Net income is gross rents received less the expenses incurred to operate the building. Expenses include real estate taxes, utilities, property management fees, advertising and other costs. It does not include the cost related to a mortgage. The gross revenue, less the operating cost is called net operating income (NOI).

What is a CAP rate?

The NOI is a number that is used to calculate the return on investment. Dividing the net operating income by the price of the property makes the calculation. The resulting calculation is called the capitalization rate, or CAP rate, which represents the return on the investment. For example:

Net operating income (NOI) = $48,000.

Property price is $600,000.

48,000/600,000 = .08 or 8% CAP rate.

How to utilize the CAP rate

An investor is looking to an eight percent return, knowing the NOI, can do another calculation to determine the price for which a property must be purchased to generate an eight percent return. For example:

Net operating income is $48,000.

The investor seeks 8% return.

48,000/.08 = $600,000 (price necessary to generate an 8% return)

There are many software programs, some free, to analyze income property. Here is a link to one. I have not evaluated it, but they have been around for years. For most investors, the cost and market approach are still required so do not overlook them. This information should reduce your risk, not eliminate it if this information is new to you.